What is Confirmation Bias?

One of the most common behavioral biases, confirmation bias is when you determine your conclusion and then gather evidence to back it up. Mindful investors gather evidence first and then make decisions based on the weight of that evidence.

One of the most common behavioral biases, confirmation bias is when you determine your conclusion and then gather evidence to back it up. Mindful investors gather evidence first and then make decisions based on the weight of that evidence. Technical analysis can tell you a great deal about the collective psychology of investors, but to get a pure read on supply and demand you need to focus solely on price behavior to ensure you don’t cloud your judgment!

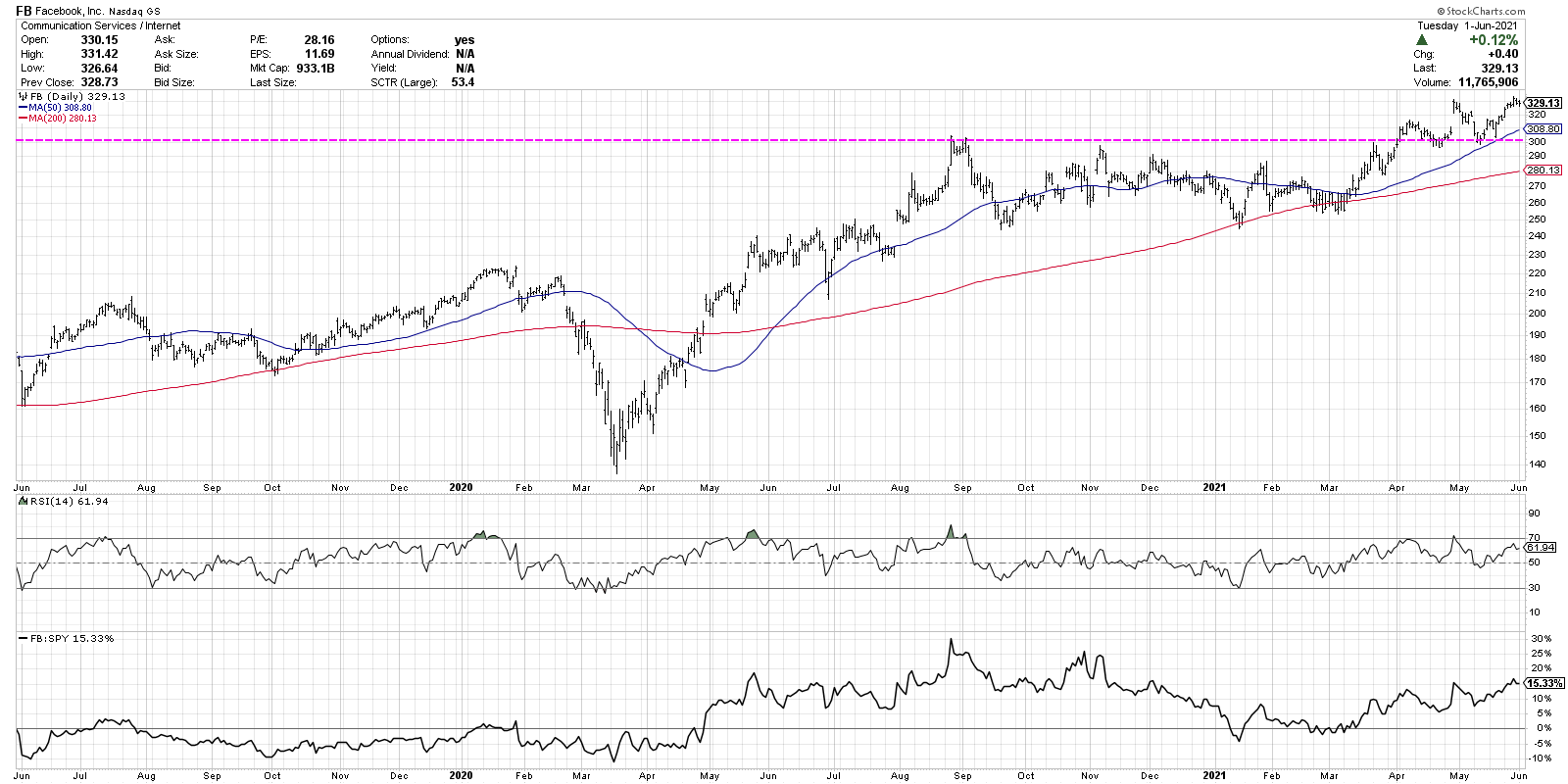

In today’s video, we'll define confirmation bias, explain how it creeps into your investment process, and review strategies to minimize its impact in your decisions. Along the way, we’ll break down the chart of Facebook (FB) using a technical checklist and explain why the path of least resistance appears higher.

· What is confirmation bias, and how does it affect your ability to gain a clear picture of investor sentiment?

· How do seasoned technical analysts disconnect the company from the stock in their thinking, allowing them to identify entry and exit points without being biased with fundamental thinking or news flow?

· What “line in the sand” would suggest a more risk-off scenario for this key benchmark name?

For deeper dives into market awareness, investor psychology and routines, check out my YouTube channel!

RR#6,

Dave

PS- Ready to upgrade your investment process? Check out my free course on behavioral investing!

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Be Mindful the Rest of the Time

Years ago, my wife and I were really into a TV show called The Biggest Loser. If you’ve never heard of it, the general premise was essentially a couple of personal trainers and fitness experts were featured on the show every week helping a group of people struggling with weight loss and body image. Over the course of the season you would see these individuals go through a dramatic multi-month transformation 30 minutes at a time, as they developed better habits and unwound destructive ones. Overall, it was pretty enjoyable to see people improve their lives, many of whom had come from very dark places not just physically, but emotionally and spiritually.

Years ago, my wife and I were really into a TV show called The Biggest Loser. If you’ve never heard of it, the general premise was essentially a couple of personal trainers and fitness experts were featured on the show every week helping a group of people struggling with weight loss and body image. Over the course of the season you would see these individuals go through a dramatic multi-month transformation 30 minutes at a time, as they developed better habits and unwound destructive ones. Overall, it was pretty enjoyable to see people improve their lives, many of whom had come from very dark places not just physically, but emotionally and spiritually.

Jillian Michaels was one of the two trainers that were regularly featured on the show. I recently came across this quote of hers:

“Allow yourself a few parties but be mindful the rest of the time.”

This quote caught my eye as I’m very keen to mindfulness and mindful investing. But I’ve struggled a bit thinking and reflecting on these words, because I feel like given where we’re at as a society, we actually can’t allow ourselves a few parties right now. With the Coronavirus pandemic and being somewhat stuck in our houses, there is a risk associated with doing anything socially. For me personally, this quote would have meant something completely different to me years ago. It would have meant indulging with food, or with drinks, or with where I was traveling.

We talk about mindful investing and having an awareness of the now in your surroundings, but there’s not a lot of allowance in there to be imperfect, or to not be mindful sometimes. What about those times when you’re just not into the now? What then?

Missteps don’t always mean falling into a spiral of negativity. They can actually refresh you and help you stay focused on your overall goals.

I suppose when approaching anything there’s a sense that we need to be perfect about it. I’m going through a process right now of attempting to upgrade my eating habits. I’m eating a lot of salads and a lot of fresh fruits and vegetables, which is a bit of a change from my beginning-of-the-Coronavirus-pandemic-nightly-gelato indulgences. I’m just trying to just clean things up and get into a better fitness routine and hopefully come out of this feeling better and doing better overall.

One of the things I’ve learned is that I’m not going to hit 100% with eating salads all the time. We had pizza last night and it tasted amazing. We were not scheduled to have pizza in our carefully curated weekly calendar of meals, but it just hit me, and I told my wife, “I think it’s pizza night. Can we please get pizza?” She very lovingly agreed. I’m finding that even with occasional missteps like random Tuesday pizza nights, overall I’m still feeling healthier. Why? Because my average experience is better. My main standard fallback meal is something relatively healthy, even with little cheats along the way.

Surround yourself with tools and resources to help you stay mindful.

In today’s world, I think this quote might suggest allowing yourself a few parties in more of a mental sense. If your goal is to lose weight dramatically, allow yourself the freedom to eat pizza sometimes. It’s not only acceptable to do this, but it will also allow you to stay true the rest of the time. It’s sort of counterintuitive because you feel like if you take a misstep then you’ll fall into a downward spiral of negativity. I don’t think so. I think it actually refreshes you. And I think you’ll find that over time you need those cheat days less and less.

Aside from these few “mental parties”, be mindful the rest of the time. Think about how your average day includes mindfulness. Think about how you’re having a healthy conversation with yourself, not just as an investor, but as a human being. How are you tracking your progress as you try to improve routines and improve decision-making? How are you improving what you put inside your head and put inside your body?

I’ve enjoyed reflecting on this quote the last couple of days. I think allowing yourself a few parties mentally, especially given the situation we’re in, can be very helpful. But also set yourself up with things that will help you be mindful the rest of time. Over the long-term, even with the ups and downs of short-term decision-making, as long as you surround yourself with the tools, resources, and support system to get you to a better place, you’re going to end up just fine.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Remembering Tony Tabell

It’s often been said that we stand on the shoulders of giants. Unfortunately, this week we lost one of the early practitioners and founders of the Market Technicians Association, Tony Tabell.

It’s often been said that we stand on the shoulders of giants. Unfortunately, this week we lost one of the early practitioners and founders of the Market Technicians Association, Tony Tabell.

Tony comes from a lineage of great technical analysts, as his father was an accomplished technician as well. His work was profiled in Andrew Lo’s great book, The Heretics of Finance, which profiled some of the great technical analysts who practiced in the 1960s, 1970s, and 1980s. Technical analysis was transitioning during this time from a pariah approach to becoming a little more mainstream. And now we find technical analysis, and especially behavioral finance which I would argue is closely related, are prolific both in financial media and in the markets.

Tony is actually related to Richard Wyckoff. For those of you familiar with Wyckoff analysis, especially my friends Roman Bogomazov and Bruce Fraser who teach this method, Richard Wyckoff is Tony Tabell’s great uncle.

Tony was one of the first presidents of the Market Technicians Association, serving from 1975-1976. This was the period just after the MTA was founded in 1973. I was president from 2010-2014 and really enjoyed learning more about the history of the organization. Part of this process was reading a lot about Tony Tabell’s work and learning about his contributions to technical analysis.

Tony was the one who came up with the idea of the MTA Annual Conference. The first one was held in 1976 with a small gathering of sell-side technical analysts. It grew broader each year and eventually evolved into the MTA Annual Symposium, or the CMT Annual Symposium as we now call it. This is one of my favorite events, and I look forward to it every year.

Tony won the MTA Annual Award in 2009, which recognizes great contribution to the field of technical analysis. This actually made him one of the few father-son recipients. His father, Edmund Tabell, was one of the first recipients of this same award, winning it about 30 years earlier in 1980.

Tony Tabell’s work in his and his father’s letters are captured at www.tabellmarketletter.com. This website presents the writings of these two great technical analysts from 1944-1992, almost a 50-year run. These letters take us through an incredible period in market history, including the recovery after World War II, the Go-Go Years of the 1960s, the 1974 and 1982 market lows, and the 1983 breakout when the Dow broke above 1000. It’s a great history lesson on the staying power of technical analysis.

What follows is a snippet from one of Tony’s notes from mid-1974, when the markets eventually bottomed out. He wrote:

It is possible to find some solace, also, in the developing patterns of individual stocks, and it is the area in which improving patterns are being seen which is to us, as technicians, of interest. Every once in a while the market will begin to show action which flies in the face of generally-accepted conventional wisdom. In early 1968, for example, the Vietnam War was at its height, with absolutely no prospect of withdrawal in sight. Yet throughout the first quarter of that year, the technical action of “peace stocks”, those companies which would be beneficiaries of the end of the war and increased consumer spending, was consistently superior to that of companies presumably benefiting from the level of war activity. At the end of March, it will be recalled, President Johnson made his momentous decision not to run for reelection that fall and to seek a cessation of the Vietnam hostilities. The result was the famous “April Fool’s Day rally,” which touched off what was ultimately to be a 170-point advance in the Dow, with the so-called “peace” stocks leading the way. It is perhaps worth noting that only the prospect of Vietnam peace was enough to set the rally off. Peace itself did not occur until four years later.

Again in 1974, the stock market patterns that seem to be developing fly in the face of current conventional wisdom. We are assured on all sides that the outlook for consumer spending is bleak, and that it is likely to turn down sharply in the second half of the year. Yet a careful inspection of stock patterns suggests that among the better ones are those belonging to a whole group of companies that would benefit from increased consumer spending.

Now decades later, the market structure, participants, and the way we analyze stocks using computing power are totally different than when Tony wrote this in 1974. However, the universality of human behavior and human psychology as a driver of stock prices is consistent. The market moves not on news and fundamentals, it moves on the expectations of these factors. It’s all about the mindset of investors and what they are expecting to see. This was the goal of the technical analyst as Tony was writing the above in 1974, and it remains the goal for the technical analyst today.

Tony Tabell’s contributions to the field of technical analysis are immense, and he will be missed. From the entire technical analysis community, rest in peace Tony.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

A Failure of Imagination

Crude oil went below zero dollars yesterday and eventually reached -$40 a barrel. I wanted to focus not necessarily on what this means for investors, but on what it means psychologically when something goes beyond a barrier you think is unbreachable.

Crude oil went below zero dollars yesterday and eventually reached -$40 a barrel. I wanted to focus not necessarily on what this means for investors, but on what it means psychologically when something goes beyond a barrier you think is unbreachable.

What actually happened was that the May crude oil future went below zero dollars. Futures and commodities roll contracts every month, so the June crude oil contract is the one that everyone is trading. This is called the “front” contract. The negative value per barrel was for the May contract, which is relatively illiquid. It’s basically wrapping up its existence and is therefore very lightly traded.

So you have this strange phenomenon with excess supply and minimal demand. There is a surplus of oil and nowhere to put it, and essentially investors in those May contracts actually have to pay someone to take their oil from them. This seems kind of counterintuitive, but it makes sense.

We don’t imagine something as even a possibility, so when it starts to happen we are unprepared for it.

Besides the logistical aspects of why crude oil went negative, let’s think more about the psychological part. We don’t think that this could happen simply because we never imagined it’s a possibility. Can crude oil actually trade in negative terms? Well, we’ve all just learned that it can.

People are struggling with this now in the fixed income markets. Yields are going negative and we have negative real interest rates, meaning instead of getting an interest rate on government debt, you lose money by owning this security. When faced with losing much more money in other assets though, it doesn’t seem like that bad of an option.

The problem is when interest rates get down to zero, as they have been in Europe, people struggle to understand what that even means. This is the essence of a failure of imagination. We don’t imagine something as even a possibility, so when it starts to happen we are unprepared for it.

“When things are so uncertain, it’s time for investors to put on their thinking caps and start to imagine what could happen. Don’t limit yourself to what your experience has been, think of what scenarios are possible.”

This is reminiscent of the US Space Program and the Apollo 1 fire. Three astronauts were trapped in the capsule on the pad during a routine testing sequence, and a fire broke out unfortunately killing three crew members. Astronaut Frank Borman testified about the incident during the congressional hearings and was asked what happened and who failed. His answer? It was a failure of imagination. They just never imagined a scenario where astronauts would be on the pad and would need to get the door opened, so they never figured out a way to do it.

We are just starting to measure the impact of the coronavirus on companies and the economy and the stock market as a whole. And we are just beginning to envision how life might actually transition into a “normalization” of the economy. When things are so uncertain, it’s time for investors to put on their thinking caps and start to imagine what could happen. Don’t limit yourself to what your experience has been, think of what scenarios are possible.

Take off the blinders, think bigger picture, think about what could happen.

If you’ve only been investing for the last 5-10 years, all you’ve really known is a cyclical bull market within a secular bull market. There are actually four other combinations, and right now we are arguably in a cyclical bear within a secular bull. At some point we will be back in a secular bear market, and those are difficult and challenging and frustrating. We may effectively be in one now, but I think that remains to be seen. These realizations tend to be much more obvious in the rearview mirror.

Now is the time as an investor to be more imaginative. Take off the blinders, think bigger picture, think about what could happen. Then look at your portfolio, look at how it is structured, and write down the ways that you would handle different scenarios. Crude oil can go below zero, interest rates can go below zero, the stock market could go down another 50% (highly unlikely, but it could). What would you do in those scenarios?

Don’t wait for the unrealistic and unexpected to happen, then start figuring out how you’re going to handle it as an investor. Imagine those possibilities now.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Bear Markets and Bike Riding

But the current market environment, with all its volatility and unexpected moves, reflects riding a bike around Washington. There are times you have to work really hard, and times when you can ease off a bit. There are big uphill and downhill moves, and it’s almost like riding around with your eyes closed in a lot of ways.

We live outside of Seattle in the foothills of the Cascade Mountains. We’re in a more rural area, so it’s pretty laid back and quiet here in the land of horse farms. The landscape is gorgeous as we have the Cascade Mountains to the east and the Olympic Mountains to the west.

I got inspired for this post while riding my bike. We live along the Tolt Pipeline Trail, which is a large pipeline that supplies about 30% of Seattle’s drinking water by transporting it from the mountains into the city. Every so often I’ll get the bright idea to take my bike out there and start riding, but if you’ve ever been to the Pacific Northwest, you know it’s incredibly hilly.

I bought this bike a few years ago when we lived in Cleveland, OH. Now if you’ve ever been to the Midwest, you know it’s very flat and the roads tend to be laid out in a grid like pattern. While riding around Cleveland, I don’t think I shifted gears maybe more than two or three times each bike ride. It just wasn’t needed as there were very few elevation changes and the roads were quite predictable.

When bike riding in Washington, however, it seems I’m shifting my gears about every 10 seconds! The conditions change constantly with long, grinding roads winding through trees. You’ll have a huge uphill slog, then you’ll shoot down a 40% grade at 30 mph. There are the occasional flat levels where you can relax and take a breather, but in general the terrain is a lot more volatile than in the Midwest.

“When looking back, I feel the best stories you will have as an investor will come from looking back at these challenging bear markets.”

As I’m finishing my ride, I started cursing myself for picking this particular route that involves a huge, painfully slow uphill all the way back to our house. It struck me how closely this relates to our current investing environment. A normal bull market that we’ve all grown accustomed to is like riding a bike around Cleveland. You have a good routine, you have a general idea of where things are headed, and you just basically maintain.

But the current market environment, with all its volatility and unexpected moves, reflects riding a bike around Washington. There are times you have to work really hard, and times when you can ease off a bit. There are big uphill and downhill moves, and it’s almost like riding around with your eyes closed in a lot of ways.

Bear markets are challenging, but they provide considerable opportunities to learn and grow.

Of course there’s nothing wrong with this sort of environment. Riding a bike through this challenging terrain is actually a great learning experience. As much as I enjoyed riding around Cleveland, I’m really enjoying it in Washington because I’m stretching myself physically, mentally, and emotionally. I’m experiencing different environments and encountering opportunities to grow as a cyclist and as a human being. You might think I would prefer the Cleveland bike routes, being flatter and certainly less physically taxing. However, I’m very much enjoying the challenges of riding around these foothills.

I feel the same with investing. Bear markets can be difficult, they have a lot of volatility and uncertainties. But when I look back at my career, I have absolutely grown more in bear market cycles than in bull markets. These are the times when you really have to grow and learn and understand. When looking back, I feel the best stories you will have as an investor will come from looking back at these challenging bear markets.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Overcoming the Endowment Effect

Given the uncertainty in the world right now both in the markets and with life in general, I seem to be getting more questions than usual submitted to the mailbag for The Final Bar on StockCharts TV. We run a mailbag segment twice a week, and it’s really a great opportunity for me to help people along in their journey of navigating the markets.

Given the uncertainty in the world right now both in the markets and with life in general, I seem to be getting more questions than usual submitted to the mailbag for The Final Bar on StockCharts TV. We run a mailbag segment twice a week, and it’s really a great opportunity for me to help people along in their journey of navigating the markets.

In particular I’m getting questions on behavioral biases, and I thought it would be helpful to take a look at one example, the Endowment Effect. We’ll discuss what it is and how to minimize its impact in your decision-making.

To illustrate this emotional bias, I will use a coffee mug that I own from The Walden School. This coffee mug is incredibly special to me, but if you owned this mug it probably wouldn’t mean that much to you. Sure, it will proudly hold your coffee or tea, but if you break it or chip it or lose it, I’m sure you have plenty of other mugs. No big loss.

The Endowment Effect explains why this coffee mug has more value to me than to you.

For me though, this mug stirs up exciting memories. The Walden School holds a musician’s retreat every summer up in the mountains of New Hampshire which I was able to attend a few years ago. I spent an amazing, unforgettable week composing and arranging music, singing and playing with other attendees, and learning from expert composers and conductors. It was transformative. Every time I see this mug, it reminds me of that exceptional week- it takes me right back. As a result, this mug actually holds more value to me than to you.

This same thing tends to happen with our portfolios. With our portfolio holdings, we attribute greater value to them simply because we own them. This is essentially the Endowment Effect. You treat items that you own differently than those you don’t, purely because of the emotional attachment to them.

“With our portfolio holdings, we attribute greater value to them simply because we own them. This is essentially the Endowment Effect.”

Imagine your portfolio has been doing well, but a couple of your holdings start underperforming. And let’s say this portfolio includes Disney. It’s a stock you’ve owned for a while. You love this stock, you love the company, you love their story, but it’s starting to rollover and is really hurting your performance. The Endowment Effect basically compels you to want to continue to hold this stock even when the evidence clearly demonstrates otherwise.

This is how it manifests itself in your investing. It starts to hurt your performance because of this emotional attachment. To help minimize this emotional bias, here are a couple tricks to help keep yourself in check.

First, try the new money trick. If you own a stock and have started debating its value in your portfolio, ask this question: If you had new money today, would you put it in this stock right now? If the answer is yes, then you probably have some decent justifications for continuing to hold your old position. If the answer is no, or the ever popular, “Well no I wouldn’t put new money in it but I’m still OK holding it” then ask this second question: If you wouldn’t put new money in it, can you really justify why you should be keeping old money in it?

Covering up the tickers removes your emotional attachment and leaves you to focus more on the evidence.

A second tactic is to cover up the tickers. If you look at charts (which hopefully you do because they are a great way to understand market history and price and dynamics), grab some charts of the stocks you own, then grab a bunch of other charts as well. Put them in a big pile, cover up all the tickers, then analyze the charts individually. See which of the charts you find most attractive, then uncover the tickers. Are the charts you own the same ones you just identified as attractive?

If there is a disconnection, see what it is about those charts that is not as appealing as you might have thought. Covering up the tickers removes your emotional attachment and leaves you to focus more on the evidence.

Strategy number three is to think of stock positions as things you rent, not that you own. This is a mental shift in how you approach your current positions. Of course, being a shareholder brings responsibilities and I’m not suggesting you ignore those! But you should think of your positions as items you are renting, and at any point you can break the lease and get out of it with no penalty. You are just renting temporarily until your money is better suited elsewhere.

The Endowment Effect can creep into your portfolio and affect your decision-making. Using these three tricks can help minimize the impact of this behavioral bias and allow you to make financial decisions without emotional influence.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

It's All in the Details

“A man’s accomplishments in life are the cumulative effect of his attention to detail.”

That’s a quote from John Foster Dulles, and if you don’t know him, you may be familiar with Washington Dulles airport which was named after him. Dulles was the Secretary of State under President Eisenhower in the 1950s.

To be honest, this quote has always bothered me. Why? I am not a detail-oriented person. At. All.

“A man’s accomplishments in life are the cumulative effect of his attention to detail.”

That’s a quote from John Foster Dulles, and if you don’t know him, you may be familiar with Washington Dulles airport which was named after him. Dulles was the Secretary of State under President Eisenhower in the 1950s.

To be honest, this quote has always bothered me. Why? I am not a detail-oriented person. At. All.

My wife will giggle when she watches this video because it has been a source of tension-turned-comedy over our 19+ years of marriage. She has a laser focus on details, while I tend to gloss over said details. For her, life is about the specifics, the details, the weeds. For me, the details are what get in the way of my understanding and appreciation for the big picture, the cosmic whole, this crazy lens with which I view the world.

Success isn’t only in the details, nor is it solely in the big picture.

It seems to me Dulles’ quote reflects how a lot of detail-oriented people think of themselves. And in turn, it’s also how they view the world and how they think of others. The ability to contribute, and the value you bring to a team and to humanity as a whole, is your ability to focus in on the details. This makes perfect sense assuming that’s how you are wired.

I, however, am not wired this way- I’m more of a big picture person. I see my contribution as helping people get out of the weeds- to think about the broad view, about relationships, about where we should be headed as a whole and not the specifics of how we get there. When I’m paired in a team environment with someone that’s more detail-oriented, we work really well together. I am able to help the group focus on big picture goals and objectives, and they focus on the process and the specifics of how we attain those goals. I keep us aiming in the right direction; they execute the game plan.

“The big picture pie-in-the-sky stuff is vital, but without the specifics to get you there, it’s just an idea.”

Both approaches are very valuable. However, my inability, or my natural unwillingness to focus on details has presented problems at times for sure. If you are more of a big picture person and can relate, hopefully these three tactics will help when details should be your focus.

First and foremost, it’s important to have a self-awareness that details are a challenge. You will find the most success when you leverage your strengths while addressing your weaknesses. Be aware and recognize those times when you are not focusing on the details enough.

Second, once you realize the need for details, schedule a time to focus on them. There are certainly times when you can’t gloss over the particulars- planning a wedding, developing a game plan, making a proposal. The big picture pie-in-the-sky stuff is vital, but without the specifics to get you there, it’s just an idea.

I don’t tend to schedule these “detail focus” times often because, well, I find them challenging at best. But for those projects where I really need to zero in, I make a point to plan a time to go through the specifics.

Are you more left-brained or right-brained? Both are vital for success.

Finally, surround yourself with systems, processes, routines, and especially people that will help you address this natural weakness. I have always found I need to surround myself with at least one other detail-oriented person. When I looked for a virtual assistant, I wanted someone who was hyper-organized because this is not my forte. It’s probably one of the most significant reasons why my wife and I have been happily married so long- we balance each other out.

My goal for those of you who are detail-oriented is this- remember that your attention to detail is not the only measure of success. It might be a part of how you measure your success, but remember that others are wired differently. Respect that difference.

If you are more of a big picture person, think about these three suggestions to help you overcome your weakness. Have a good self-awareness, schedule times when you really need to dig into the weeds, and surround yourself with people, processes, and routines that will help you become more successful overall.

An interesting point to note- for investors, there is a big balance between the left-brain detail-oriented investment style and the right-brain broader investment style. In one of my other videos, I discuss this whole brain investment process of balancing the left-brain detail with the right-brain big picture creative thinking.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

What "Work" Actually Means

Believe it or not, “work” can actually mean standing still.

In my previous role at a large financial institution, I found that “work” meant “activity”. When someone was working, a lot of times that meant they were taking action…

Believe it or not, “work” can actually mean standing still.

In my previous role at a large financial institution, I found that “work” meant “activity”. When someone was working, a lot of times that meant they were taking action – actually doing something physically. Work was defined as something tactile or physical, like email for example. If you wanted to feel good about what you were accomplishing, culturally, you needed to spend a lot of time on emails.

“If you wanted to feel good about what you were accomplishing, culturally, you needed to spend a lot of time on emails.”

Unfortunately, when work is limited to the likes of email, it means a lot of very helpful things don’t count as work- like thinking, or reading, or coming up with strategies. I have been in meetings where people were praised for responding to emails very quickly. I remember thinking to myself, “Wait- if they are sitting and watching their emails that closely and are able to immediately respond, what are they actually accomplishing?”

I love this quote by George MacDonald- “There is such a thing as sacred idleness, the cultivation of which is now fearfully neglected.” Sacred idleness basically means you can take time to take a step back. You can take time to quiet yourself and your approach. You can take time and really focus on what is meaningful, and what is going to help move you toward your objectives.

“There is such a thing as sacred idleness, the cultivation of which is now fearfully neglected.”

As so many of us are now dealing with social distancing and working from home/ working remotely, we have more of an opportunity than ever to find those moments of sacred idleness during the workday.

My challenge for you this week is to think about where you can take a moment for sacred idleness. When can you take step back and read something that’s been on your reading list? When can you take time to meditate, or talk to your family? When can you take those steps back so you can evaluate your overall trajectory and make sure you’re focusing on the most important things?

You may find that these moments give rise to your best work of the day.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Two Ways to Fight FOMO

FOMO is something we’ve talked about in investing for awhile now, especially after more than a decade of bull markets in stocks. FOMO, or the Fear Of Missing Out, is what is motivating investors to continue to buy stocks on the way up- this idea that stock prices could go to the moon and they don’t want to miss out …

FOMO is something we’ve talked about in investing for awhile now, especially after more than a decade of bull markets in stocks. FOMO, or the Fear Of Missing Out, is what is motivating investors to continue to buy stocks on the way up- this idea that stock prices could go to the moon and they don’t want to miss out on this upside opportunity. Now that the market has reversed in the last 4-6 weeks and has gone down aggressively 20-30+%, it’s a different type of fear that is motivating people. Instead of the fear of missing out, it’s now the fear of losing everything- the fear of being insolvent and getting crushed by this market.

Yet even during this severe downtrend there will be days where the market is up 5-10% in one day. And this, in my opinion, is FOMO-driven buying. There is this fear of missing the bottom- this fear that the market is going to go all the way back up to the previous highs. Investors are afraid of missing out on this initial move thinking that others are taking advantage. In general, it makes sense to pay attention to the longer-term trends and not get too caught up in using fear as a motivator for any buy and sell decisions.

“In general, it makes sense to pay attention to the longer-term trends and not get too caught up in using fear as a motivator for any buy and sell decisions.”

What’s interesting is that FOMO is prevalent in a lot of other places as well. I discovered it recently in my own day-to-day process. I’ve spent a lot of time over the years trying to improve my processes and routines. I look to find better ways to manage my priorities and my time, and to make sure I’m working in line with my values. And I’ve written quite a lot on MarketMisbehavior.com about different approaches to self-improvement.

But I noticed something this past week, now that I’m working from home pretty extensively here in Western Washington. I use Pocket, which is both an App and a website that allows you to save links to web pages for later. If you see an article you want to read, instead of distracting yourself and spending time on it right then and there, you can hit a button and save it to your “pocket”. Later, when you have time, you can go through and read those stories.

Often what these websites are doing with their “clickbaity” headlines is tapping into that FOMO, or that fear of missing out. They want you to get the sense that you are missing out if you don’t read that article. That’s the whole nature of these eye-catching headlines and images- they use FOMO to draw you into those articles and help support them through their advertisers.

Don’t let FOMO creep into your everyday process.

I think of myself as someone who is well read. I try to read a lot and often, and I try to consume a lot of good information to stay well-rounded and have a good understanding of what’s going on around me. But what I’ve come to realize is what is really motivating me is not the need to be informed and to be aware and to understand. It’s really, more than anything, the fear of missing out that’s motivating me to save those articles to Pocket.

And here’s how I know- I just checked, and my Pocket account has over 400 articles that I’ve saved over the last couple of years. At times I have chipped away and brought it down to maybe 225 articles after some serious devoted reading sessions, but in general, I’m saving way more than I’m reading. And I’ve noticed that in my vast Pocket queue, some of those articles are from a year ago- they aren’t even relevant anymore! And some links, now that I’m looking with a clear head, it’s not even apparent why I saved them in the first place.

And this is the dilemma. It is so easy to fall victim to that fear of missing out. For me, just the act of saving a link to my Pocket is what scratched that itch- that’s what made it all better. Not actually reading that article. Not actually gaining wisdom from that article. Just the simple act of saving that link and having it available to me later was enough. This may be reminiscent of your own Amazon wishlist- things you add but never intend to buy. I have found myself adding a book I want to read to my wishlist, and by doing so, I have effectively relieved myself of the duty of actually reading that book.

The fear of missing out can creep in at anytime. No one wants to spend all day saving links to some mystical queue they’re never going to tackle. So to fight that FOMO urge, I’m suggesting two strategies.

First, be intentional about what you’re actually saving for later. What books do you really think are going to help improve you as a person or enrich your life? What articles do you really need to read that are going to materially impact your ability to grow personally and professionally? Instead of just flagging them for later, what things could you put on your Amazon wishlist that you really do intend to buy? It’s OK to just let all the other stuff go. And if you do this at the start, if you make sure you’re filtering out all the noise and are only capturing the good stuff, you’ll have a much smaller, much more manageable list of really meaningful things to go through when you have time.

Second, be intentional and thoughtful about when you are actually going to approach these items. Set a time. For me, I actually schedule time on my calendar every Friday to go through my Pocket queue. I also try to schedule time to read books, but as with most things, I feel I could do a better job of finding times both in the mornings and the evenings to read. You can always refine and improve your processes!

If you are intentional about what you save for later and purposeful about the time devoted to those items, you will filter out the noise and be left with only what is meaningful. You’ll then have time to go through what really matters and take action. If you do this, you’ll find you are enriching your life personally and professionally.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Dealing with Bear Markets

In case you’ve missed it, we have recently found ourselves in a bear market environment.

The first quote I want to share with you about this market environment is,

“Bull markets are great, but they breed complacency. Bear markets can be energizing. Instead of fretting over the decline in your net worth think opportunistically about all of those bargains and the potential gains when inevitably a bull market returns.” – James B. Stewart

In case you’ve missed it, we have recently found ourselves in a bear market environment. The first quote I want to share with you about this market environment is,

“Bull markets are great, but they breed complacency. Bear markets can be energizing. Instead of fretting over the decline in your net worth think opportunistically about all of those bargains and the potential gains when inevitably a bull market returns.” – James B. Stewart

This was published in the Wall Street Journal in 2008 as the market was selling off and going into a bear market territory.

It’s funny, during bull market phases we have quotes like:

“Don’t confuse brains will the bull market.”

and

“Everyone’s a genius in a bull market.”

Things feel fantastic when the market is going up and a lot of times we attribute our investment success to skill and as great investors, we should be able to create these great returns. When the market goes down we start blaming less our own skill and instead, blaming bad luck (i.e. the market is moving against us, this is just how things are going, etc.).

As an investor, I have always found that I have grown way more during bear market phases than bull market phases. It is very easy to become complacent when the market is going up and everything is working. When the market goes down, it becomes a great opportunity to reevaluate your process, decide what has or has not been working, and think about how you can prepare yourself for the next bear market phase.

I have been through a couple of these phases now since my initial introduction in the mid-2000s. My initial introduction to investing was during the 2001-2002 bear market, which included 9/11 (and other similar crazy times living in the New York area), then again the 2007-2009 bear market phase, and smaller phases such as 2015 and others which were gentle but frustrating bear market phases.

I will tell you that the complacency that manifests itself during bull markets evaporates very quickly when things begin to go down and begin people to see red in their portfolio.

My second quote by Peter Lynch will hopefully give you some inspiration to consider,

“People who succeed in the stock market also accept periodic losses, setbacks and unexpected occurrences. Calamitous drops do not scare them out of the game.”

Over the years I’ve spent a lot of time working with institutional investors and the one big difference I have seen between institutional investors, money managers managing large portfolios, and individuals managing their own money, is risk aversion, or a way of handling losses. Professional money managers know that losses are part of the game. They know that bear markets happen and in a situation like this when the market is down 20%+ they view it as an opportunity to buy good companies at a bargain. They look for new opportunities, consider where they can sell their losers, and find new ways to ride the leg, being fairly certain that this bear market phase will be followed by a bull market phase (as it has happened every time in history).

I found that when the market goes down your phone will ring significantly more because your clients will want to know what to do. When the market is going up, they worry less because they don’t feel they need your help, but when the market is going down they do find they need your help.

It is important to remind people to remember that losses are part of investing, just like gains are. If you look at the long-term trend in stocks (depending on where you start) the equity markets have provided a consistent 6-10% annualized return (again, depending on the window you look at). There are periods where it has lost a great amount of money, but the reality is it is always mean reverted back to that long-term uptrend and, if history is our guide, we can expect that at some point that will return. The good news is I found bear markets are a great opportunity to learn as long as you can stomach the capital loss and use it as an opportunity to reinvent yourself and your process.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.

Hi I’m Dave! Thanks so much for checking out the blog. Check out our free behavioral investing course and don’t miss an episode of Dave’s daily market recap show!

“Those who can not remember the past are condemned to repeat it.”