A Failure of Imagination

Crude oil went below zero dollars yesterday and eventually reached -$40 a barrel. I wanted to focus not necessarily on what this means for investors, but on what it means psychologically when something goes beyond a barrier you think is unbreachable.

What actually happened was that the May crude oil future went below zero dollars. Futures and commodities roll contracts every month, so the June crude oil contract is the one that everyone is trading. This is called the “front” contract. The negative value per barrel was for the May contract, which is relatively illiquid. It’s basically wrapping up its existence and is therefore very lightly traded.

So you have this strange phenomenon with excess supply and minimal demand. There is a surplus of oil and nowhere to put it, and essentially investors in those May contracts actually have to pay someone to take their oil from them. This seems kind of counterintuitive, but it makes sense.

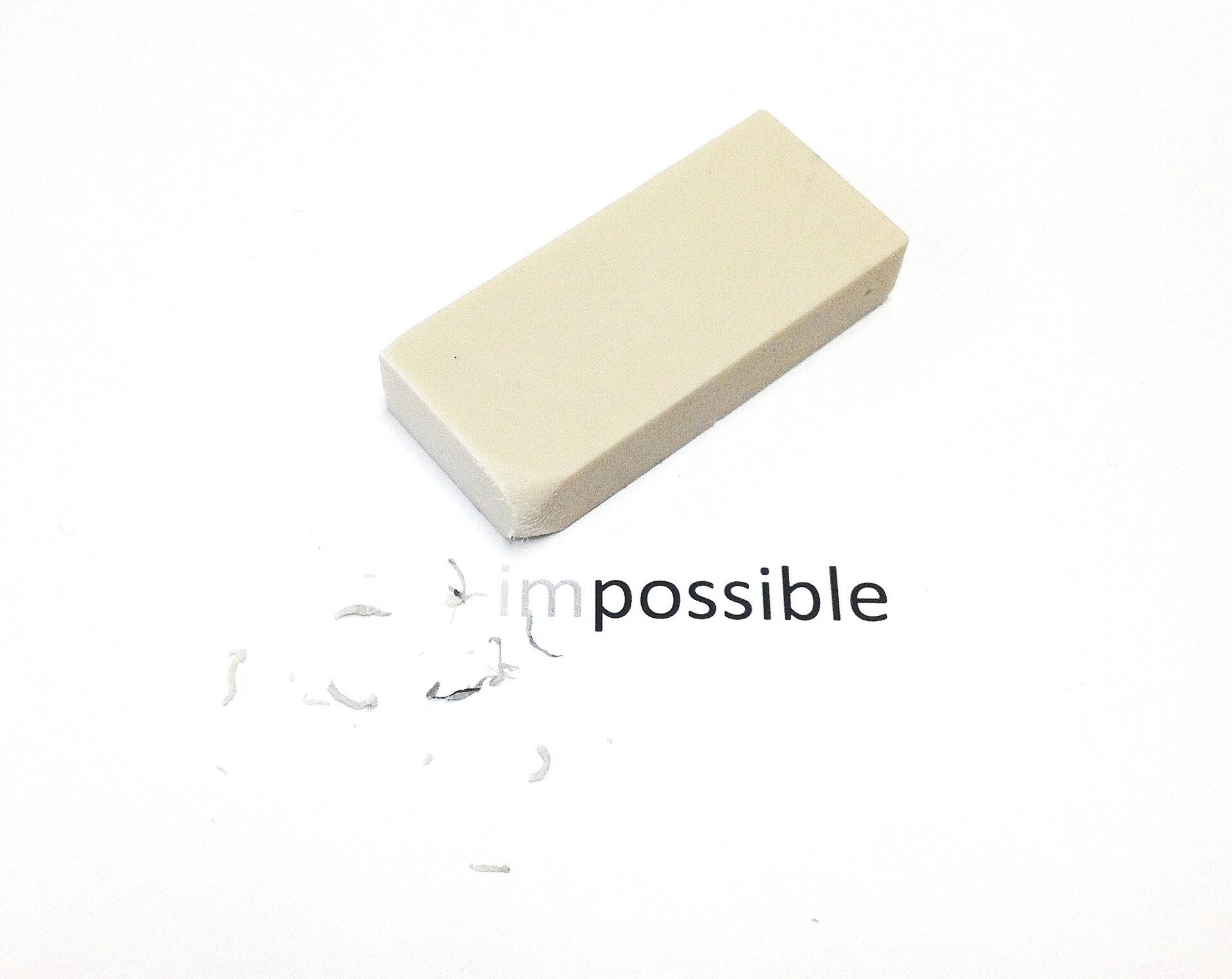

We don’t imagine something as even a possibility, so when it starts to happen we are unprepared for it.

Besides the logistical aspects of why crude oil went negative, let’s think more about the psychological part. We don’t think that this could happen simply because we never imagined it’s a possibility. Can crude oil actually trade in negative terms? Well, we’ve all just learned that it can.

People are struggling with this now in the fixed income markets. Yields are going negative and we have negative real interest rates, meaning instead of getting an interest rate on government debt, you lose money by owning this security. When faced with losing much more money in other assets though, it doesn’t seem like that bad of an option.

The problem is when interest rates get down to zero, as they have been in Europe, people struggle to understand what that even means. This is the essence of a failure of imagination. We don’t imagine something as even a possibility, so when it starts to happen we are unprepared for it.

“When things are so uncertain, it’s time for investors to put on their thinking caps and start to imagine what could happen. Don’t limit yourself to what your experience has been, think of what scenarios are possible.”

This is reminiscent of the US Space Program and the Apollo 1 fire. Three astronauts were trapped in the capsule on the pad during a routine testing sequence, and a fire broke out unfortunately killing three crew members. Astronaut Frank Borman testified about the incident during the congressional hearings and was asked what happened and who failed. His answer? It was a failure of imagination. They just never imagined a scenario where astronauts would be on the pad and would need to get the door opened, so they never figured out a way to do it.

We are just starting to measure the impact of the coronavirus on companies and the economy and the stock market as a whole. And we are just beginning to envision how life might actually transition into a “normalization” of the economy. When things are so uncertain, it’s time for investors to put on their thinking caps and start to imagine what could happen. Don’t limit yourself to what your experience has been, think of what scenarios are possible.

Take off the blinders, think bigger picture, think about what could happen.

If you’ve only been investing for the last 5-10 years, all you’ve really known is a cyclical bull market within a secular bull market. There are actually four other combinations, and right now we are arguably in a cyclical bear within a secular bull. At some point we will be back in a secular bear market, and those are difficult and challenging and frustrating. We may effectively be in one now, but I think that remains to be seen. These realizations tend to be much more obvious in the rearview mirror.

Now is the time as an investor to be more imaginative. Take off the blinders, think bigger picture, think about what could happen. Then look at your portfolio, look at how it is structured, and write down the ways that you would handle different scenarios. Crude oil can go below zero, interest rates can go below zero, the stock market could go down another 50% (highly unlikely, but it could). What would you do in those scenarios?

Don’t wait for the unrealistic and unexpected to happen, then start figuring out how you’re going to handle it as an investor. Imagine those possibilities now.

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. Please see the Disclaimer page for full details.