Bubblicious Irrationality

When I saw this Bloomberg article on bubble conditions, I immediately thought of last weekend at the Behavioral Finance Symposium in San Francisco. I helped run a workshop on the relationship of behavioral finance to trading and technical analysis.

One of the topics of our discussion, which was also addressed in presentations the following day, was herding and investors' behavioral tendency to group into similar positions.

Even more interesting than the content of the discussion were the introductions, where we went around the room and introduced ourselves. This was the first time I ever heard anyone introduce themselves with "Bitcoin Trader" being their primary profession.

Now to be honest, ten years from now this may be a very common career path. But today, it made me stop and think a bit. Could this be one of the key items on a "How We Know We're in a Bubble" checklist?

One thing was clear to me- this Bitcoin Trader was someone committed to the success of cryptocurrencies in a room full of people that were fairly skeptical of the success of cryptocurrencies.

When I settled back into my office this week, I grabbed my weathered copy of Robert Shiller's Irrational Exuberance for a few moments of reflection. Chapter Eight, entitled "Herd Behavior and Epidemics," begins like this:

A fundamental observation about human society is that people who communicate regularly with one another think similarly. There is at any place and in any time a Zeitgeist, a spirit of the times. It is important to understand the origins of this similar thinking, so that we can judge the plausibility of theories of speculative fluctuations that ascribe price changes to faulty thinking.

Interestingly, that first sentence was written well before social media was even a thing. Now I've found that the more I use social media, the more it becomes an echo chamber of my own perspectives. It's become more difficult than ever to find differing opinions that allow me to challenge my own preconceived notions.

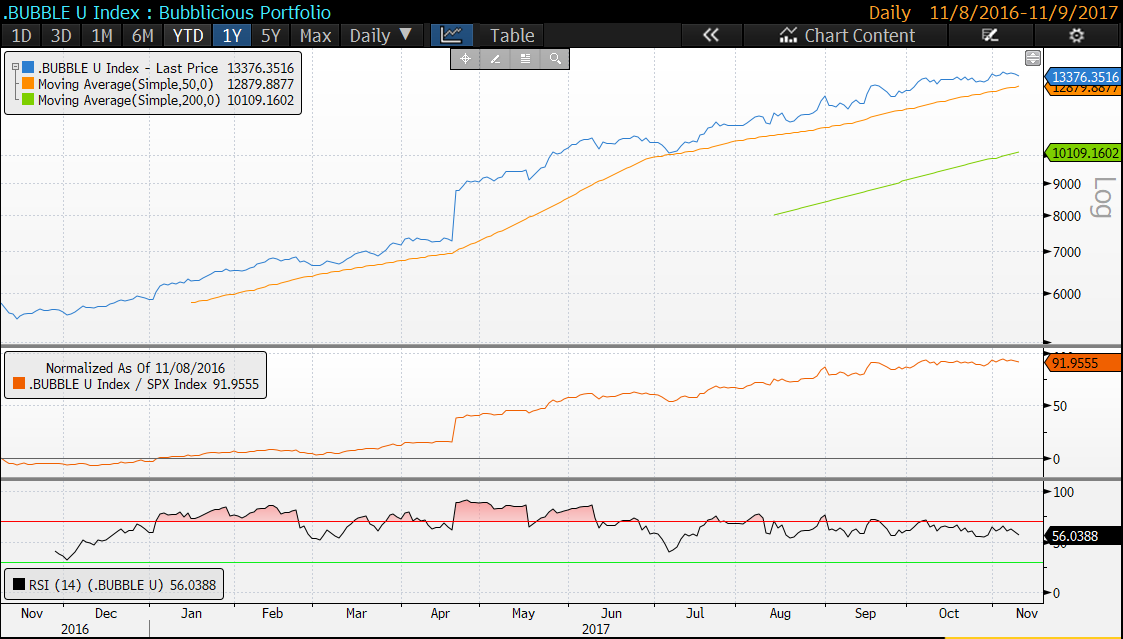

Here's a chart of the "Bubblicious Portfolio" described in the article.

The only way to evaluate a bubble, or challenge your investment thesis, is to look at it with emotionless eyes. And a big part of that process is to explore other points of view, reflect on their merits, and then compare them to your own.

What are you doing to step out of the echo chamber and evaluate your perspectives?

RR#6,

Dave

Disclaimer: This blog is for educational purposes only, and should not be construed as financial advice. Please see the Disclaimer page for full details.