What’s Next for the S&P 500? October 2024 Update!

What’s your take on the S&P 500 as we wrap up 2024? Are you bullish, anticipating the index surging past 6000 before year’s end? Or do the recent signs of elevated volatility, breadth divergences, and other red flags have you more cautious, thinking Q4 might bring a downturn? Let’s explore the possibilities.

First, we’re here to stretch our thinking beyond biases by considering a range of scenarios for the S&P 500. By doing so, we open ourselves to the full spectrum of outcomes—whether extremely bullish or bearish. Second, I’ll guide you in deciding which scenario aligns most with your view, so you can prepare your portfolio accordingly. But remember: staying flexible is key, as any of these scenarios could become reality.

Our Game Plan and market context

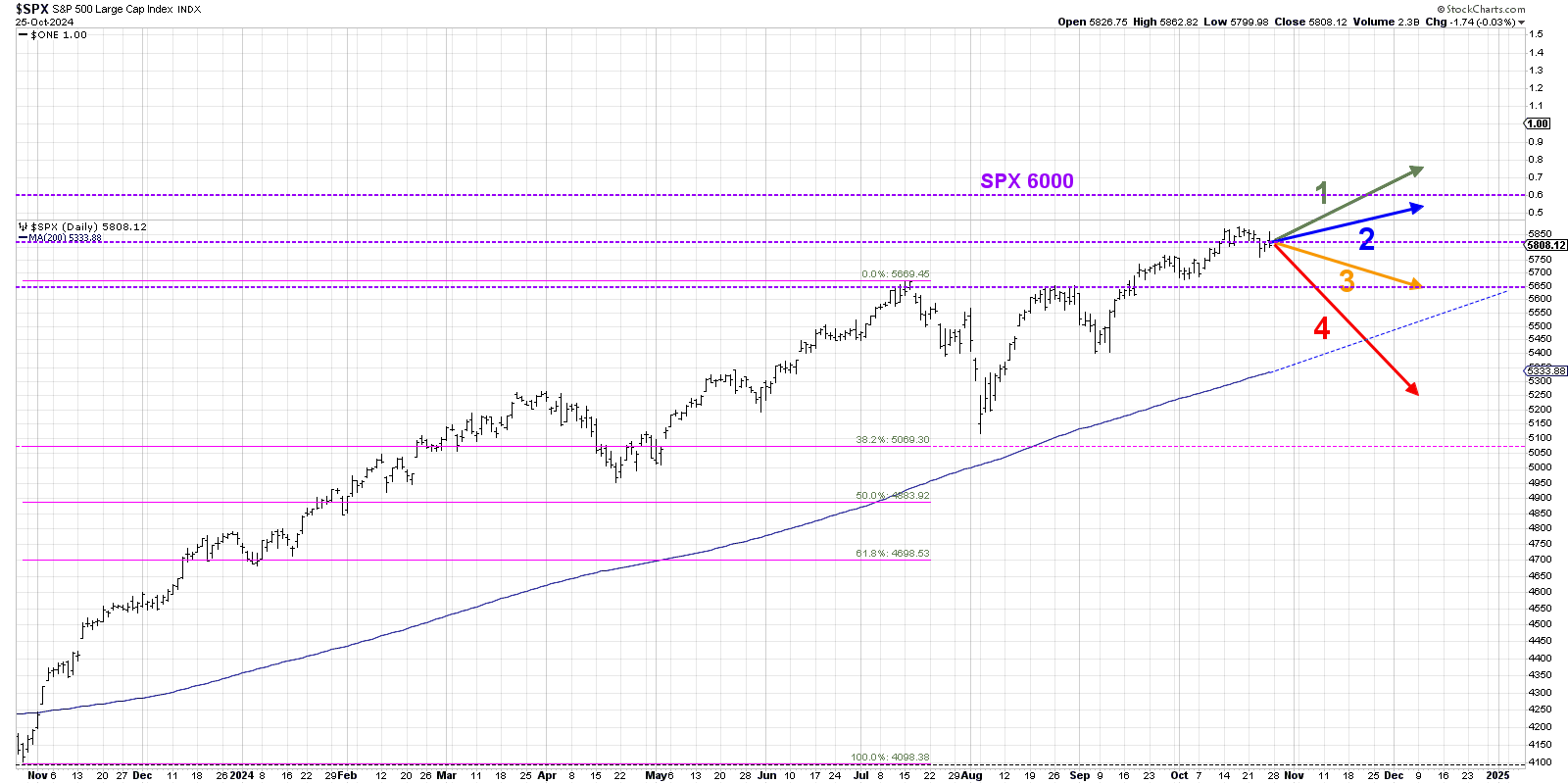

I’ll lay out four potential scenarios for the S&P 500, each with specific conditions, key levels, and signals to watch. Think about these scenarios, and be sure to drop a comment below to share which one you think is most likely and why!

Let’s start with a quick look back. Over the past year, the S&P 500 has remained in an almost relentless uptrend with minimal pullbacks. The biggest drawdown, from the July peak to an early August low, was less than 10%! Since hitting that low in August, we’ve observed three straight months of strength into October. So, what’s next? Let’s review these four potential scenarios.

Scenario One: The Super Bullish Case

This scenario envisions a steady continuation of the trend off the August low, with the S&P climbing higher into December. If this pace holds, we could break above 6000 by early December, potentially setting new all-time highs. This would echo the low-volatility, consistent gains we experienced in Q1. Key signals to watch include a series of higher highs and lows and sustained momentum.

Scenario Two: The Mildly Bullish Case

In the mildly bullish scenario, the S&P 500 edges higher, but struggles to cross the 6000 threshold. We may see resistance due to psychological price barriers, valuation concerns, or underwhelming earnings reports. This scenario would likely see the S&P hovering around 5900-5950, with market breadth indicators possibly weakening—a signal that could set the stage for a more pronounced correction heading into year-end.

Source: StockCharts.com

Scenario Three: The Mildly Bearish Case

Here, the market loses momentum without breaking down entirely. In this scenario, the S&P pulls back slightly but holds above the critical 5650 level and stays above the 200-day moving average. This would imply continued long-term strength, even as short-term caution creeps in. But if the Magnificent 7 names experience any sort of drawdown into November, a scenario like this becomes much more likely.

Scenario Four: The Super Bearish Case

In the most bearish outcome, we see a significant downturn reminiscent of late 2018, with a powerful downtrend emerging in Q4. This scenario would mean a break below both 5650 and the 200-day moving average. As institutions pivot to defensive plays, sectors like utilities, real estate, and consumer staples might start to lead the market.

As we look to early December, earnings reports, the U.S. elections, Federal Reserve announcements, economic data, and global events will all shape the S&P’s path.

So, where do you stand? Do you see a super bullish rally continuing? A mild move up or down? Or a more bearish turn for Q4? Drop your thoughts below with your reasoning—what indicator or driver do you think will trigger your chosen scenario?

RR#6,

Dave

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.